Often, when reading news from California, one wonders whether the state is at the forefront of innovation or delusion. California’s fixation with climate change and electric vehicles serves as example.

Here is a quote from one of the more progressive members of San Francisco’s Board of Supervisors, Rafael Mandelman.

“We have to take action to expand our public EV-charging infrastructure and make EV ownership more accessible and practical for all San Franciscans.” … “Our curbside EV charging program is not just about installing charging stations. It’s about creating a more equitable and sustainable transportation ecosystem.” The City wants to add thousands of EV chargers by 2030, San Francisco Examiner, March 19, 2024.

San Francisco, as California, does have ambitious climate mandates, including plans for EVs for everyone and a ban on the sale of new gas-powered cars after 2035.

Given the real world, such climate ambitions border on delusional.

Supervisor Mandelman must be aware that San Francisco is projecting a deficit of $245 million in 2025 and a deficit of $554 million in 2026. He must also be aware that about 10% of the City’s residents live below San Francisco’s poverty rate, necessitating substantial subsidies if this population segment is to switch from gas-powered cars to EVs.

It is unknown whether Supervisor Mandelman wants to include the City’s 7,700 plus homeless population in his “equitable and sustainable transportation ecosystem.”

The high cost directly associated with EVs is not the only issue. Well-known shortcomings of current EVs include unreliable performance in extreme weather, need for more frequent charging than gasoline fill-ups, and electric grids that limit EV charging to specific times.

Beyond immediate inconveniences, EVs pose environmental challenges of their own.

Industry boasts that 95% of battery components can be recycled; extraordinarily expensively, but it can be done. However, industry seldom mentions that EV battery recycling is in its infancy, placing in question whether EV mandates are getting ahead of recycling capacity. As we all know, EV batteries are the last thing one would want in a landfill.

Although extraction of minerals necessary to produce EV batteries – mainly lithium and cobalt –is increasing, only a few countries extract these minerals in significant quantities. Australia, Chile and China extract the most lithium, while the Democratic Republic of the Congo extracts 70% of the world supply of cobalt. If EV mandates continue at the present rate, how long until environmentalists jump on the environmental challenges posed by widespread mining?

Despite mandates and incentives, drivers in the U.S. are not entirely sold on electric vehicles, according to an April 2023 Gallup poll. Current ownership is of EVs in the U.S. is only 4%. Gallup summarizes as follows.

“While ownership of electric vehicles is on the rise in the U.S., the percentage of Americans who say they own one remains limited at 4%. Though they are often promoted as a key way to reduce carbon dioxide emissions and address the effects of climate change, the public remains largely unconvinced that the use of EVs accomplishes this aim.”

As with all consumer goods, electric vehicles respond to price competitiveness and consumer needs. Without those two essentials, adoption of EVs at present can significantly increase only through government intervention. And here is where leaders like the aforementioned member of San Francisco’s Board of Supervisors, Rafael Mandelman, comes in.

Money to subsidize projects is never really a problem for governments, since taxpayers willing to fork over their hard-earned cash are always available. Consumer concerns with EVs are easily overcome by removing the alternative of purchasing gas-powered vehicles. Uneasiness with widespread mining is minimized by exporting environmental degradation.

Leaders have created a delusional world where petroleum disappears without credible supplies of products to replace petroleum and its thousands of derivatives. They have created an unnatural market where people buy what they don’t really want.

In the real world and the real market place innovators step in with new products that reliably and competitively replace products that no longer satisfy consumers. When whale bone became too costly due to overkilling of whales, plastics were invented. The decline of silkworms brought on the invention of nylon.

But, what can today reliably fly the thousands of airplanes in our skies except petroleum? What can credibly replace the hundreds of plastic products in our homes, especially our less affluent homes? Nothing. Because oil is efficient, and kept cheap relative to alternatives in large part as a result of government subsidies.

“The oil and gas industry is expected to reap $1.7 billion in 2025 from the intangible drilling tax break, and $9.7 billion over the next 10 years, according to the White House. It is expected to realize $880 million in benefits from the depletion allowance tax break in 2025, and $15.6 billion by 2034.” The Zombies of the U.S. Tax Code: Why Fossil Fuels Subsidies Seem Impossible to Kill, The New York Times, March 20, 2024.

As long as oil is efficient and relatively cheap, it will take either gargantuan innovation to make EVs competitive or massive taxpayer-funded subsidies to make EVs affordable.

The real, non-delusional world, seldom allows us to have our cake and eat it too.

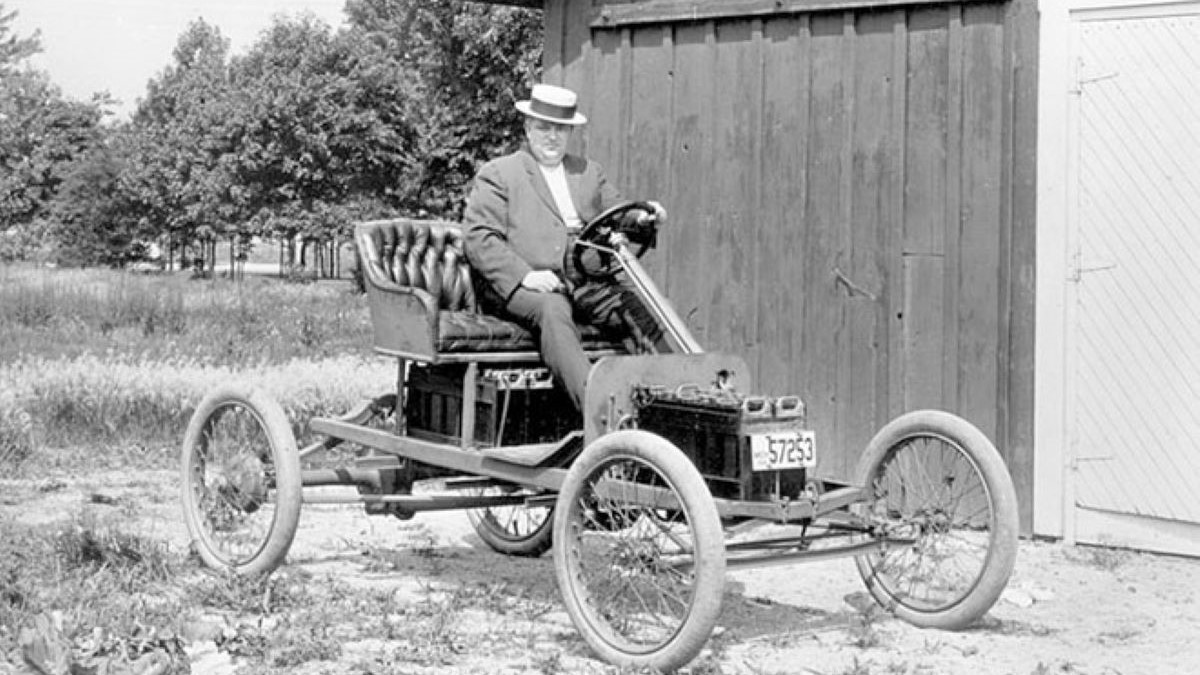

Pictured: Henry Ford’s electric vehicle prototype. The dream of electric vehicles is not new. Henry Ford worked with Thomas Edison for several years on an EV project before abandoning it. Some say the project did not work because of battery shortcomings, and some say the oil companies conspired to deep-six the project. Good article on the subject on Wired Magazine, Ford, Edison and the Cheap EV That Almost Was, June 18, 2010.