On August 1, 2024, rules under President Joe Biden’s revision of Title IX go into effect. The new Title IX reverses the revisions provided by former President Donald Trump, which in turn reversed the revisions provided by former President Barack Obama.

Title IX has become a special kind of proverbial political football, as it grows bigger and more adorned with every presidential administration.

The rules, commonly known as Title IX, were signed into law by then President Richard M. Nixon as part of the Education Act of 1972. Title IX was a straightforward command based on the 14th Amendment’s Constitutional principle of equal protection under the law. It read,

“No person in the United States shall, on the basis of sex, be excluded from participation in, be denied the benefits of, or be subject to discrimination under any educational programs or activity receiving federal financial assistance.”

This 37-word directive worked just fine for three decades after its enactment, providing major educational opportunities for girls and women. Educational institutions could no longer exclude women from elite sports, courses, and activities – exclusions that were the norm rather than exceptions.

The original Title IX was not without opposition, especially from those concerned about its effect on time-honored and often lucrative men’s sports. However, all states complied with and implemented Title IX rules.

As time passed, meanings for the words “discrimination” and “sex” proliferated. In the case of Title IX, discrimination no longer simply meant not providing equal treatment, and sex no longer simply meant a difference in number of chromosomes or bodily characteristics.

Along with the growing interpretations of what is discrimination, of what is sex as opposed to gender as opposed to identity, and of who belongs to what category, came the proliferation of agendas. In 2024, the new Title IX looks more like a salad bowl of schemes than a necessary, ethical and Constitutional effort to provide equal protection under the law.

Yes, the argument can be made that the original 1972 Title IX broke with some conventions accepted by many at the time: Family and society need women as caregivers not as scholars or athletes. Elite educational institutions need the revenue and prestige brought by men’s athletics. Women’s athletics would dilute revenue and prestige. Women don’t like sports, anyway. However, all states accepted and complied with the new rules without major revolt.

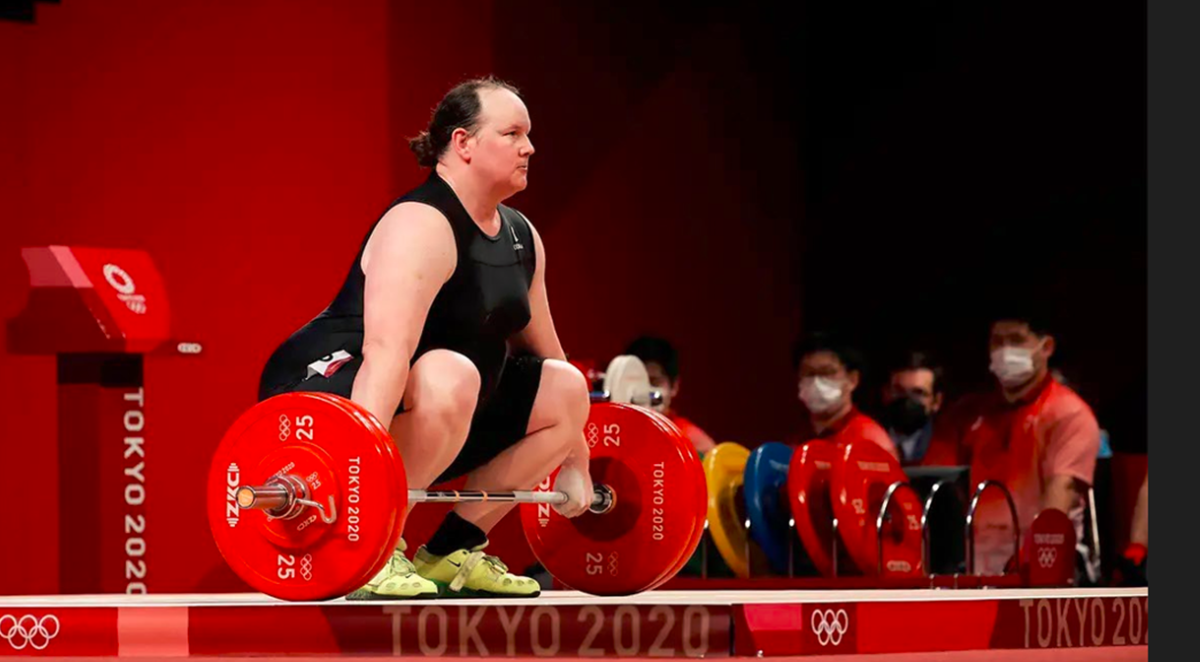

The argument can also be made that a woman’s team that includes a biological male would have an advantage over an all-biological female team. And that would be a good thing for the inclusive team.

However, attorneys general in Alabama, Arkansas, Florida, Georgia, Idaho, Indiana, Iowa, Kentucky, Louisiana, Missouri, Mississippi, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Virginia, and West Virginia have sued the Biden administration, arguing primarily that the administration exceeded its authority changing Title IX. Governors and state education officials in Arkansas, Florida, Louisiana, Montana, Oklahoma Nebraska, South Carolina, and Texas have directed their states’ educational institutions not to comply with the new Title IX rules.

The position of conservative, Republican-led states is that the new rules are a bridge too far in its intent to ignore physical differences by requiring protection against discrimination based on gender identity. Although the new rules stop short of specifically permitting biological men that identify as women competing in women’s sports, the rules lead to such permission by adding gender identity to protected characteristics.

Certainly, a biological male athlete that has received at least 2 years of gender-affirming care prior to puberty could claim his muscle size and strength is comparable to that of a biological female. Totally fair to allow him in women’s sports. But, nowhere in Title IX rules does that eventuality appear, thereby opening the doors to biological males unfairly competing with biological females.

The new Title IX rules are not only unfair to women but are also loaded with nuances likely to cause confusion.

The original 1972 Title IX established a new, straightforward rule that did not exist prior to the title’s enactment. The new 2024 Title IX heaps more prohibitions against infractions that are already punishable under federal, state and local laws, purportedly to tailor said infractions to sex and gender. For example, harassment, assault, violence, and stalking are already punishable. It should be questionable whether the new Title IX rules needed to list all of these already punishable infractions under “sex based” behavior – and why the rules did so. Is a sexual assault on a campus that receives federal assistance any different than a sexual assault in a shopping mall’s parking lot?

Legislators passed the original 1972 Title IX to help end the evident unfairness inherent in the exclusion of women from elite sports, courses, and educational activities. The Title IX rules helped women to achieve excellence in fields previously closed to them. If federal, state, and local jurisdictions abide by existing laws against all harassment and other violence, is there really a need for more than the original Title IX? Probably not. But factions have not resisted the urge to use Title IX as an agenda-driven political football.

Picture: New Zealand’s Laurel Hubbard, a trans athlete, competed in the women’s weightlifting team in the 2020 Tokyo Olympics. Hubbard was eligible to compete because his testosterone level was below the maximum allowed trans athletes at the time. Requirements did not take into account that if transgender care starts after puberty, biological males will keep their muscular advantage over females.